Understanding SORN and SORN meaning

In this article, we’ll delve into the intricacies of SORN and SORN meaning, providing a comprehensive guide to help you navigate this aspect of vehicle ownership. If you’re a vehicle owner in the United Kingdom, you may have come across the term “SORN.” But what does SORN mean, and how does it affect you and your vehicle?

What is SORN?

SORN stands for “Statutory Off Road Notification.” It is a legal declaration made by a vehicle owner to inform the authorities that their vehicle is not in use on public roads and, therefore, is exempt from vehicle tax. This declaration is essential for vehicles that are not being driven or parked on public roads, as the UK requires all vehicles used or parked on public roads to be taxed.

When is SORN Necessary?

- Off-Road Storage: If you have a vehicle that is not in use and is kept off the road, whether in a garage, on private property, or in any location that is not a public road, you need to declare SORN.

- No Tax Disc: Historically, a tax disc was displayed on the windscreen of taxed vehicles. However, with the transition to digital records, a SORN declaration serves as an official notification that your vehicle is off the road and exempt from vehicle tax.

How to Declare SORN:

Declaring SORN is a straightforward process, and you can choose from various methods:

- Online: The most convenient method is to declare SORN online through the official government website. You’ll need the 16-digit reference number from your vehicle tax renewal reminder (V11) or the 11-digit reference number from your log book (V5C).

- By Phone: You can also declare SORN by phone. The relevant phone number is available on your vehicle tax reminder letter.

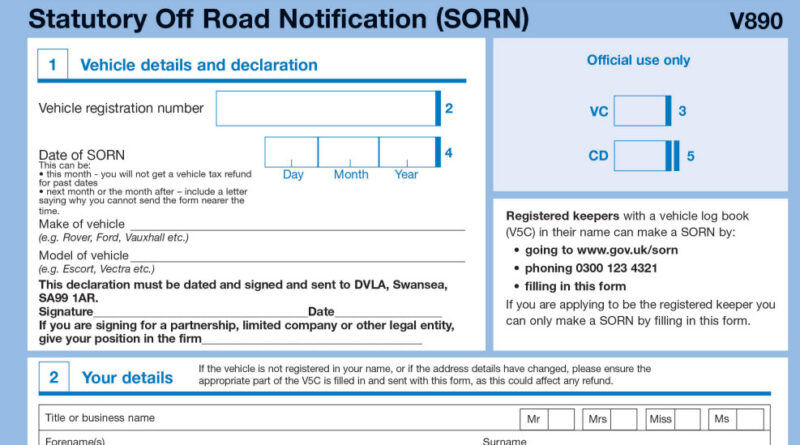

- By Post: If you prefer a traditional approach, you can declare SORN by filling out a SORN form (V890) and sending it to the DVLA by post. The form is available for download on the official government website.

Important Considerations:

- Insurance: While SORN exempts your vehicle from vehicle tax, it doesn’t relieve you of the obligation to have insurance if your vehicle is not declared off the road and uninsured.

- MOT Requirements: Even if your vehicle has a SORN declaration, it might still need a valid MOT certificate if it is over three years old. Check the MOT requirements and ensure compliance.

- Returning to the Road: If you plan to use your vehicle on public roads again, you must tax it before driving. This includes obtaining a valid MOT certificate if applicable.

Penalties for Non-Compliance:

Failure to declare SORN when your vehicle is off the road can lead to penalties, fines, and possible prosecution. It’s crucial to notify the authorities promptly when your vehicle is not in use to avoid any legal consequences. Understanding UK number plates.

Conclusion:

In summary, SORN is a statutory declaration that informs authorities that your vehicle is off the road and exempt from vehicle tax. Whether your vehicle is in storage, undergoing repairs, or not in use for any reason, understanding and complying with SORN requirements is essential for responsible vehicle ownership in the UK. Always stay informed about the regulations and use the available channels to declare SORN when necessary, ensuring a smooth and lawful vehicle ownership experience.

Buying a used VW. Vauxhall, BMW, Jaguar, Ford, Volvo, Range rover, Bentley, Aston Martin, Porsche, Ferrari, Lamborghini, Maserati, Hyundai