Guide What is Diminished Value?

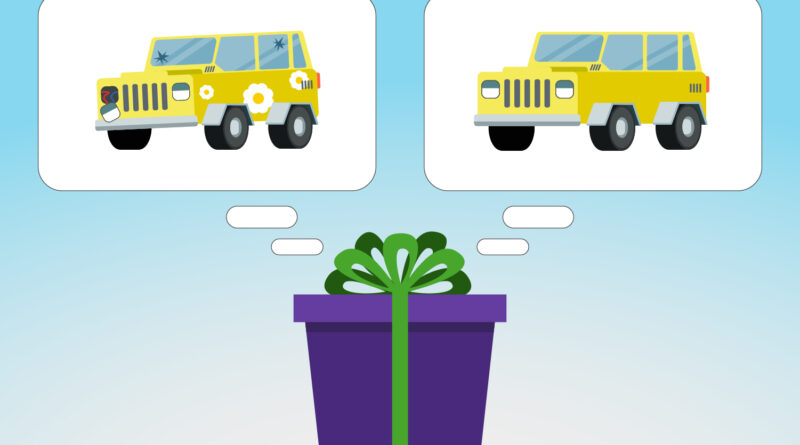

This guide will delve into what is diminished value, the types, factors influencing it, and how to claim it. Diminished value is a crucial concept for car owners and buyers alike. It refers to the reduction in a vehicle’s market value after it has been involved in an accident and subsequently repaired. Despite repairs, the mere fact that the vehicle has a history of damage makes it less appealing to potential buyers, thus lowering its overall value.

What is Diminished Value?

Diminished value is the loss in a car’s value following an accident and repair. This reduction in value occurs because potential buyers typically prefer vehicles without any history of damage. Even with impeccable repairs, a car that has been in an accident will generally sell for less than an identical one with no accident history.

Following Types:

- Immediate: This type of diminished value occurs immediately after an accident but before any repairs are made. It represents the difference in the vehicle’s market value before and after the accident.

- Inherent: Inherent diminished value is the most commonly recognized form. It refers to the loss in value that remains even after the vehicle has been repaired to its pre-accident condition. The fact that the vehicle has a damage history still impacts its resale value.

- Repair-Related: This type occurs when the repairs are substandard or incomplete. Issues such as mismatched paint, structural problems, or the use of non-original parts can further reduce the vehicle’s market value.

Factors Influencing Diminished Value

Several factors affect:

- Severity of the Accident: More severe accidents usually result in higher diminished value due to extensive damage and necessary repairs.

- Age and Mileage: Newer vehicles with lower mileage typically experience higher diminished value because buyers expect them to be in near-perfect condition.

- Make and Model: High-end luxury cars or rare models might experience a greater loss in value compared to more common vehicles.

- Quality of Repairs: The quality of repairs significantly influences diminished value. High-quality repairs can minimize the loss, whereas poor repairs can increase it.

- Market Perception: Market sensitivity to a vehicle’s accident history also plays a role in determining diminished value.

Calculating Diminished Value

Calculation can be complex. Here are common methods:

- 17c Formula: Often used by insurance companies, this formula estimates value based on a percentage of the vehicle’s pre-accident value, adjusted for damage severity and mileage.

- Appraisal Method: A professional appraiser evaluates the vehicle’s condition, accident history, and repair quality to provide an accurate value estimate.

- Market Comparison: Comparing sales prices of similar vehicles with and without accident histories can offer a practical estimate of value.

Claiming incorrect appraisal:

To seek compensation especially if you’re not at fault:

- File a Claim: Contact the at-fault party’s insurance company to file a claim. Provide evidence of the vehicle’s pre-accident condition, repair quality, and an appraisal if possible.

- Negotiate: Be prepared to negotiate with the insurance company. Having a professional appraisal strengthens your case.

- Legal Action: If the insurance company refuses to pay a fair amount, consider legal action. Consulting with an attorney who specializes in loss claims can be beneficial.

Understanding calculation is essential for car owners dealing with the aftermath of an accident. It represents a significant financial impact, reducing a vehicle’s market value even after quality repairs. Knowing how to calculate and claim ensures that car owners can recover some of their losses and receive fair compensation. Whether you’re filing an insurance claim or buying a used car, being aware of diminished value and its implications can lead to more informed decisions and better financial outcomes.