Understanding Market Value vs Agreed Value in Car Insurance

In this guide, we’ll explore the factors of understanding market value vs agreed value in car insurance. Car insurers typically compensate policyholders based on either market value or agreed value in car Insurance, each with its distinct features. When unfortunate incidents, such as theft or irreparable damage, occur to your car, insurance coverage becomes essential. Find car valuation data.

Market Value vs. Agreed Value: Unveiling the Differences

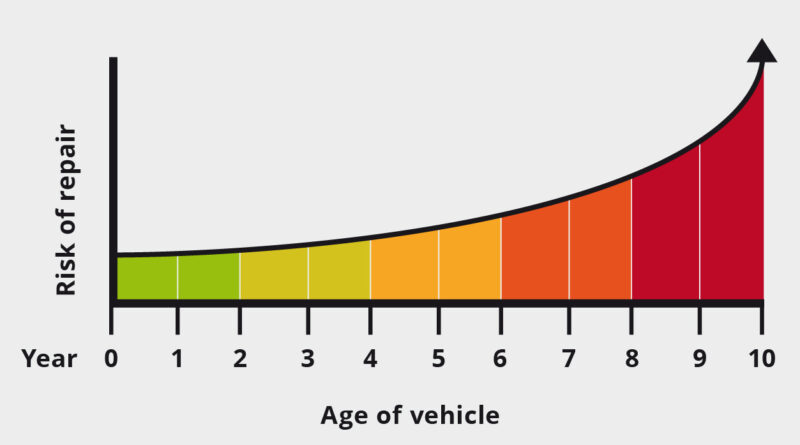

In most cases, car insurance policies lean towards paying out the market value. This value is determined by the insurer, considering the vehicle’s worth when written off, referencing similar models in the market. Different car insurance types.

On the contrary, agreed value is a pre-determined sum established at the policy’s inception, providing stability throughout the policy period, irrespective of market fluctuations.

Why Agreed Value Matters

For policyholders with agreed value coverage, periodic reviews during renewals are crucial. The vehicle’s value may have increased, necessitating an adjustment to ensure adequate coverage.

While market value aims to replace the vehicle with a similar one, it might fall short based on market conditions. Agreed value policies, however, safeguard owners by guaranteeing the agreed figure, offering a more reliable protection.

Determining Vehicle Worth: A Comprehensive Approach

To establish the vehicle’s worth, applicants should submit photographs, and for modified or restored cars, invoices can help validate the car’s value. Occasionally, an independent valuation may be required.

Cost Considerations: Market Value vs. Agreed Value Policies

Agreed value insurance policies are generally pricier due to the higher agreed sum compared to market value. The insurance premium reflects this gap, adjusting higher to cover the increased agreed value.

For those seeking to economize on insurance costs, adjusting the agreed value lower than the market rate might be an option. However, this practice is rare.

Choosing the Right Policy: Consider Your Vehicle Type

Certain cars are better suited to agreed value policies, especially:

- Classic Cars: Where market value can vary significantly, agreed value ensures a fair price, considering their potential as restoration projects.

- Performance Cars: With fluctuating market values, agreed value protects against instant depreciation and potential financial loss.

- Modified Cars: Agreed value recognizes the cost of modifications, whereas market value may not consider these enhancements.

- Kit Cars: Unusual builds benefit from agreed value, reflecting the time, money, and uniqueness invested in their creation.

- Imported and Collector Vehicles: With limited market comparables, agreed value provides the best protection against write-offs.

Securing an Agreed Value Policy: A Specialized Search

For vehicles suited to agreed value policies, specialized insurers, especially those focusing on classics, are more likely to offer such coverage. While few insurers provide agreed value policies, diligent research is crucial for finding a competitive rate.

In instances where the insurer may not agree with the proposed vehicle valuation, negotiation or exploring alternative insurers is acceptable. Independent valuations can serve as a valuable tool in reaching a fair agreement between the applicant and the insurer.

In conclusion, understanding the nuances between market value and agreed value policies empowers car owners to make informed decisions tailored to their unique vehicles and circumstances.

Buying a used VW. Buying used vauxhall, BMW, Jaguar, Ford, Volvo, Range rover, Bentley, Aston Martin, Porsche, Ferrari, Lamborghini, Maserati, Hyundai, Tesla, Honda, Pagani