Understanding Category N Cars: Insurance Write-Off Due to Non-Structural Damage

When searching for a used car, you may come across vehicles labeled as Category N cars. Category N, formerly known as Category D, is a classification used by insurance companies to categorize vehicles that have been involved in accidents but have suffered non-structural damage. It’s important to understand what Category N means and consider the implications before purchasing such a vehicle. Here’s a brief guide to help you navigate the world of Category N cars.

What is Category N? Category N is an insurance write-off category that indicates a vehicle has sustained non-structural damage in an accident. Non-structural damage refers to issues that are primarily cosmetic or related to electrical and mechanical components, rather than the underlying structure or safety-critical parts of the vehicle.

Understanding the Insurance Write-Off Process: When an insurance company determines that the cost of repairing a vehicle exceeds its market value, they may declare it a total loss and issue a settlement to the owner. In the case of Category N, the vehicle has non-structural damage that is deemed repairable. The insurance company decides not to repair the vehicle and instead pays a settlement to the owner, who can then choose to repair the car independently.

Considerations When Buying a Category N Car:

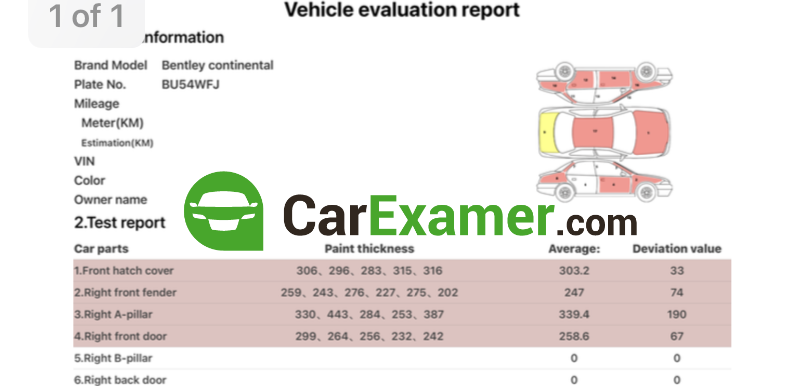

- Thorough Inspection: Before purchasing a Category N car, it’s crucial to conduct a comprehensive inspection by a professional mechanic or qualified technician. They can assess the extent of the damage and determine the repairs required to restore the vehicle to a roadworthy condition.

- Quality of Repairs: Since Category N cars have undergone independent repairs, it’s important to assess the quality of the work performed. Ensure that the repairs are carried out by reputable professionals who follow proper repair procedures and use genuine parts.

- Vehicle History Check: Conduct a thorough vehicle history check using the vehicle identification number (VIN). This will provide information about the car’s accident history, previous repairs, and mileage discrepancies.

- Insurance and Financing: While Category N cars are considered repairable, some insurance companies may charge higher premiums due to their accident history. Additionally, if you plan to finance the purchase, verify with the lender if they are willing to provide financing for a Category N vehicle.

- Resale Value: It’s worth considering that Category N cars may have a lower resale value compared to similar vehicles with a clean history. This can impact your ability to sell the vehicle in the future.

- Safety Concerns: While Category N cars don’t have structural damage, it’s important to ensure that all repairs address safety-related components, including airbags, seat belts, and electrical systems. Thoroughly inspect and test these elements to ensure they function correctly.

Purchasing a Category N car requires careful evaluation and attention to detail. Assess the extent of the damage, the quality of repairs, and the associated costs. Consult with professionals, review the vehicle history, and consider the potential impact on insurance and resale value. By conducting thorough research and making an informed decision, you can potentially find a cost-effective option that meets your needs. Always prioritize safety and quality in your evaluation process to ensure a reliable and enjoyable driving experience. Why not to read about insurance cat s issues.

Buying a used VW. Buying used vauxhall, BMW, Jaguar, Ford, Volvo, Range rover, Bentley, Aston Martin, Porsche, Ferrari, Lamborghini, Maserati, Hyundai, Tesla, Honda, Pagani