Comprehensive Guide to UK Vehicle Tax Rates

This guide delves into the intricacies of UK vehicle tax rates, providing valuable insights for both new and existing vehicle owners. Vehicle Excise Duty (VED), commonly known as vehicle tax, is a crucial financial obligation for most UK vehicle owners. By navigating these rates effectively, motorists can make informed decisions, ensuring compliance with tax regulations and optimizing their motoring costs. Road Tax Exemption.

- CO2 Emissions and Tax Bands:

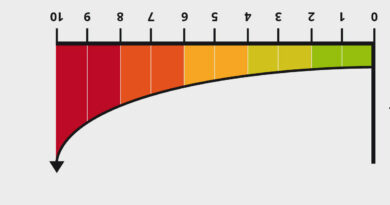

- Decode how CO2 emissions impact vehicle tax rates, with the government categorizing cars into different emission bands.

- Explore how lower-emission vehicles attract lower tax rates, creating an eco-friendly and cost-effective approach to vehicle ownership.

- First-Year Rates vs. Standard Rates:

- Uncover the nuances between first-year and standard vehicle tax rates, emphasizing the influence of CO2 emissions.

- Learn how subsequent years offer potentially lower tax liabilities, making long-term cost management a strategic consideration. How to tax your car.

- Alternative Fuel Vehicles:

- Discover how alternative fuel vehicles, such as hybrids, enjoy reduced vehicle tax rates, encouraging the use of environmentally friendly fuels.

- Gain insights into the government’s incentive structure for promoting sustainable fuel alternatives.

- Zero Emission Vehicles:

- Explore the complete exemption from vehicle tax for fully electric and zero-emission vehicles.

- Understand how this exemption aligns with environmental goals, fostering the widespread adoption of electric cars.

- Historic Vehicles:

- Learn about the exemption from vehicle tax for historic vehicles aged over 40 years, contributing to the preservation of the UK’s automotive heritage.

- Unearth the significance of this exemption in supporting and celebrating classic vehicles.

- Disabled Drivers and Passengers:

- Delve into the reduced or zero vehicle tax rates applicable to vehicles adapted for disabled drivers or passengers.

- Understand the government’s commitment to providing accessible and affordable transportation options for disabled individuals.

Cars registered on or after 1 April 2017, First tax payment when you register the vehicle

You’ll pay a rate based on a vehicle’s CO2 emissions the first time it’s registered.

This also applies to some motorhomes.

You have to pay a higher rate for diesel cars that do not meet the Real Driving Emissions 2 (RDE2) standard for nitrogen oxide emissions. You can ask your car’s manufacturer if your car meets the RDE2 standard.

| CO2 emissions | Diesel cars (TC49) that meet the RDE2 standard and petrol cars (TC48) | All other diesel cars (TC49) | Alternative fuel cars (TC59) |

|---|---|---|---|

| 0g/km | £0 | £0 | £0 |

| 1 to 50g/km | £10 | £30 | £0 |

| 51 to 75g/km | £30 | £130 | £20 |

| 76 to 90g/km | £130 | £165 | £120 |

| 91 to 100g/km | £165 | £185 | £155 |

| 101 to 110g/km | £185 | £210 | £175 |

| 111 to 130g/km | £210 | £255 | £200 |

| 131 to 150g/km | £255 | £645 | £245 |

| 151 to 170g/km | £645 | £1,040 | £635 |

| 171 to 190g/km | £1,040 | £1,565 | £1,030 |

| 191 to 225g/km | £1,565 | £2,220 | £1,555 |

| 226 to 255g/km | £2,220 | £2,605 | £2,210 |

| Over 255g/km | £2,605 | £2,605 | £2,595 |

This payment covers your vehicle for 12 months.

Rates for second tax payment onwards

| Fuel type | Single 12 month payment | Single 12 month payment by Direct Debit | Total of 12 monthly payments by Direct Debit | Single 6 month payment | Single 6 month payment by Direct Debit |

|---|---|---|---|---|---|

| Petrol or diesel | £180 | £180 | £189 | £99 | £94.50 |

| Electric | £0 | N/A | N/A | £0 | N/A |

| Alternative | £170 | £170 | £178.50 | £93.50 | £89.25 |

Alternative fuel vehicles include hybrids, bioethanol and liquid petroleum gas.

Vehicles with a list price of more than £40,000

You have to pay an extra £390 a year if you have a car or motorhome with a ‘list price’ of more than £40,000. You do not have to pay this if you have a zero emission vehicle.

The list price is the published price of the vehicle before it’s registered for the first time. It’s the price before any discounts are applied.

You only have to pay this rate for 5 years (from the second time the vehicle is taxed).

Check the list price with your dealer so you know how much vehicle tax you’ll have to pay.

| Fuel type | Single 12 month payment | Single 12 month payment by Direct Debit | Total of 12 monthly payments by Direct Debit | Single 6 month payment | Single 6 month payment by Direct Debit |

|---|---|---|---|---|---|

| Petrol or diesel | £570 | £570 | £598.50 | £313.50 | £299.25 |

| Alternative | £560 | £560 | £588 | £308 | £294 |

Cars registered between 1 March 2001 and 31 March 2017

The rate of vehicle tax is based on fuel type and CO2 emissions.

CO2 emission details are shown on the car’s V5C registration certificate, or you can find emission details online.

Petrol car (TC48) and diesel car (TC49)

| Band and CO2 emission | Single 12 month payment | Single 12 month payment by Direct Debit | Total of 12 monthly instalments by Direct Debit | Single 6 month payment | Single 6 month payment by Direct Debit |

|---|---|---|---|---|---|

| A: Up to 100g/km | £0 | £0 | N/A | N/A | N/A |

| B: 101 to 110g/km | £20 | £20 | £21 | N/A | N/A |

| C: 111 to 120g/km | £35 | £35 | £36.75 | N/A | N/A |

| D: 121 to 130g/km | £150 | £150 | £157.50 | £82.50 | £78.75 |

| E: 131 to 140g/km | £180 | £180 | £189 | £99 | £94.50 |

| F: 141 to 150g/km | £200 | £200 | £210 | £110 | £105 |

| G: 151 to 165g/km | £240 | £240 | £252 | £132 | £126 |

| H: 166 to 175g/km | £290 | £290 | £304.50 | £159.50 | £152.25 |

| I: 176 to 185g/km | £320 | £320 | £336 | £176 | £168 |

| J: 186 to 200g/km | £365 | £365 | £383.25 | £200.75 | £191.63 |

| K*: 201 to 225g/km | £395 | £395 | £414.75 | £217.25 | £207.38 |

| L: 226 to 255g/km | £675 | £675 | £708.75 | £371.25 | £354.38 |

| M: Over 255g/km | £695 | £695 | £729.75 | £382.25 | £364.88 |

*Includes cars with a CO2 figure over 225g/km but were registered before 23 March 2006.

Alternative fuel car (TC59)

| Band and CO2 emission | Single 12 month payment | Single 12 month payment by Direct Debit | Total of 12 monthly instalments by Direct Debit | Single 6 month payment | Single 6 month payment by Direct Debit |

|---|---|---|---|---|---|

| A: Up to 100g/km | £0 | N/A | N/A | N/A | N/A |

| B: 101 to 110g/km | £10 | £10 | £10.50 | N/A | N/A |

| C: 111 to 120g/km | £25 | £25 | £26.25 | N/A | N/A |

| D: 121 to 130g/km | £140 | £140 | £147 | £77 | £73.50 |

| E: 131 to 140g/km | £170 | £170 | £178.50 | £93.50 | £89.25 |

| F: 141 to 150g/km | £190 | £190 | £199.50 | £104.50 | £99.75 |

| G: 151 to 165g/km | £230 | £230 | £241.50 | £126.50 | £120.75 |

| H: 166 to 175g/km | £280 | £280 | £294 | £154 | £147 |

| I: 176 to 185g/km | £310 | £310 | £325.50 | £170.50 | £162.75 |

| J: 186 to 200g/km | £355 | £355 | £372.75 | £195.25 | £186.38 |

| K*: 201 to 225g/km | £385 | £385 | £404.25 | £211.75 | £202.13 |

| L: 226 to 255g/km | £665 | £665 | £698.25 | £365.75 | £349.13 |

| M: Over 255g/km | £685 | £685 | £719.25 | £376.75 | £359.63 |

*Includes cars with a CO2 figure over 225g/km but were registered before 23 March 2006.

Cars and light goods vehicles registered before 1 March 2001

The rate of vehicle tax is based on engine size.

Private or light goods (TC11)

| Engine size (cc) | Single 12 month payment | Single 12 month payment by Direct Debit | Total of 12 monthly instalments by Direct Debit | Single 6 month payment | Single 6 month payment by Direct Debit |

|---|---|---|---|---|---|

| Not over 1549 | £200 | £200 | £210 | £110 | £105 |

| Over 1549 | £325 | £325 | £341.25 | £178.75 | £170.63 |

Other vehicle tax rates

Light goods vehicles (TC39)

Registered on or after 1 March 2001 and not over 3,500kg revenue weight (also known as maximum or gross vehicle weight).

| Single 12 month payment | Single 12 month payment by Direct Debit | Total of 12 monthly instalments by Direct Debit | Single 6 month payment | 6 months by Direct Debit |

|---|---|---|---|---|

| £320 | £320 | £336 | £176 | £168 |

Euro 4 light goods vehicles (TC36)

Registered between 1 March 2003 and 31 December 2006, Euro 4 compliant and not over 3,500kg revenue weight.

| Single 12 month payment | Single 12 month payment by Direct Debit | Total of 12 monthly instalments by Direct Debit | Single 6 month payment | 6 months by Direct Debit |

|---|---|---|---|---|

| £140 | £140 | £147 | £77 | £73.50 |

Euro 5 light goods vehicles (TC36)

Registered between 1 January 2009 and 31 December 2010, Euro 5 compliant and not over 3,500kg revenue weight.

| Single 12 month payment | Single 12 month payment by Direct Debit | Total of 12 monthly instalments by Direct Debit | Single 6 month payment | 6 months by Direct Debit |

|---|---|---|---|---|

| £140 | £140 | £147 | £77 | £73.50 |

Motorcycle (with or without sidecar) (TC17)

| Engine size (cc) | Single 12 month payment | Single 12 month payment by Direct Debit | Total of 12 monthly instalments by Direct Debit | Single 6 month payment | 6 months by Direct Debit |

|---|---|---|---|---|---|

| Not over 150 | £24 | £24 | £25.20 | N/A | N/A |

| 151-400 | £52 | £52 | £54.60 | 28.60 | 27.30 |

| 401-600 | £80 | £80 | £84 | £44 | £42 |

| Over 600 | £111 | £111 | £116.55 | £61.05 | £58.28 |

Tricycles (not over 450kg unladen) (TC50)

| Engine size (cc) | Single 12 month payment | Single 12 month payment by Direct Debit | Total of 12 monthly instalments by Direct Debit | Single 6 month payment | 6 months by Direct Debit |

|---|---|---|---|---|---|

| Tricycle not over 150 | £24 | £24 | £25.20 | N/A | N/A |

| All other tricycles | £111 | £111 | £116.55 | £61.05 | £58.28 |

Trade licences

You can get trade licences for between 6 and 12 months, depending on the month you apply.

| Month you apply | When the licence expires | How long it’s valid for | Rate of duty for all vehicles | Rate of duty for bicycles and tricycles |

|---|---|---|---|---|

| January (6 month licence) | June | 6 months | £90.75 | £61.05 |

| January (12 month licence) | December | 12 months | £165 | £111 |

| February | December | 11 months | £165 | £111 |

| March | December | 10 months | £151.25 | £101.75 |

| April | December | 9 months | £136.10 | £91.55 |

| May | December | 8 months | £121 | £81.40 |

| June | December | 7 months | £105.85 | £71.20 |

| July | December | 6 months | £90.75 | £61.05 |

| August | June | 11 months | £165 | £111 |

| September | June | 10 months | £151.25 | £101.75 |

| October | June | 9 months | £136.10 | £91.55 |

| November | June | 8 months | £121 | £81.40 |

| December | June | 7 months | £105.85 | £71.20 |

Effectively navigating UK vehicle tax rates involves considering factors like CO2 emissions, fuel type, and a vehicle’s age. Staying informed empowers vehicle owners to comply with tax regulations, make economically sound choices, and contribute to environmental sustainability. Whether driving a traditional combustion engine or an eco-friendly electric vehicle, understanding vehicle tax rates is paramount for managing motoring costs strategically.

Buying a used VW. Buying used vauxhall, BMW, Jaguar, Ford, Volvo, Range rover, Bentley, Aston Martin, Porsche, Ferrari, Lamborghini, Maserati, Hyundai, Tesla